Today DigitalOcean announced that it is acquiring Cloudways. This is massive news in the web hosting world because Cloudways is one of the largest managed cloud hosting providers of SaaS services. According to DigitalOcean’s investor announcement, the acquisition is projected to increase “high spend” customers by 18% while not impacting operating profits and free cash flows.

The biggest takeaway is that DigitalOcean is poised to steal market share from Linode, Vultr, AWS, and Google Compute Engine.

DigitalOcean is Already 50% of Cloudways’ Customer Base

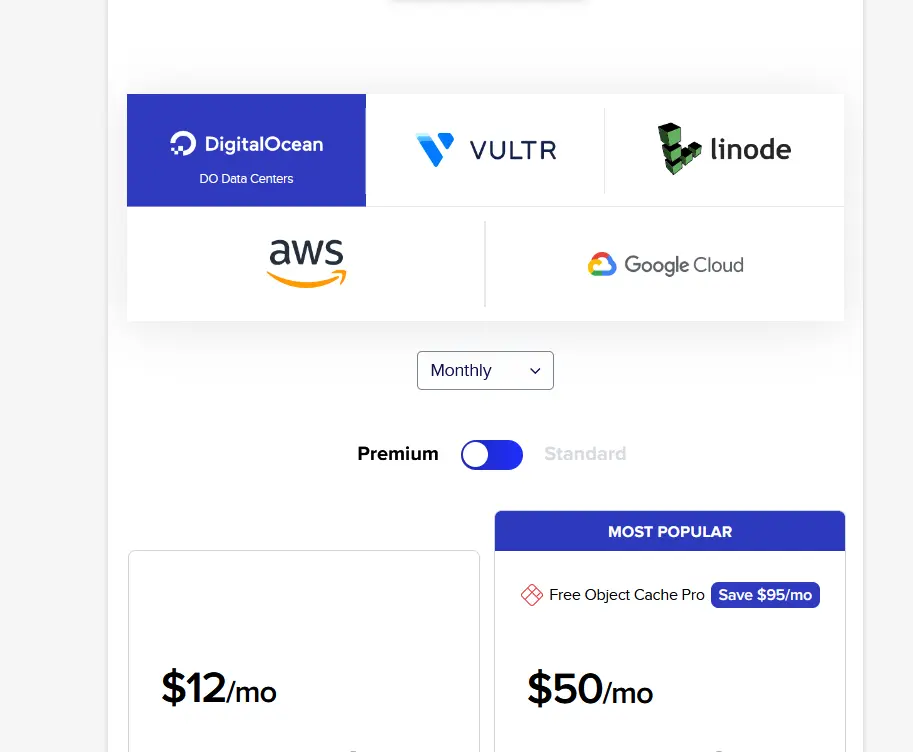

Unlike a traditional VPS server, Cloudways uses the infrastructure of cloud providers like DigitalOcean, AWS, and Google Compute Engine to prepackage servers in various configurations. This can be much cheaper than a traditional VPS, particularly with DigitalOcean. As you can see in this screenshot, DigitalOcean is the preferred provider for Cloudways:

Currently, DigitalOcean already accounts for 50% of Cloudways’ subscriber base. So acquiring Cloudways is a natural synergy and will allow even tighter platform integration.

DigitalOcean Will Suck Market Share Away from Linode and Vultr

Cloudways will continue to run as a separate business from now, and there’s no reason to assume that existing customers on platforms other than DigitalOcean will see any change. After all, Cloudways currently generates $52 million in revenue, and there’s no reason to throw away free cash flow.

But the tighter integration of DigitalOcean with Cloudways will undoubtedly lead to fewer costs and improved features on Cloudways that will attract more customers away from AWS and Google Compute Engine. So I expect to see DigitalOcean bag an even larger share of Cloudways’ customers than the existing 50%, all of which will boost DigitalOcean’s revenues in the long term.

Greater Vertical Integration with Cloudways

With the acquisition of Cloudways, DigitalOcean can now offer services one step higher in the value chain. DigitalOcean’s strength was the ease of use with which customers could fire up a VPS server and build their network architecture, such as load balancers. But customers still had to install the software independently and manage security and other configurations. Working with a managed VPS is hard enough, but setting up and configuring an unmanaged VPS requires a different skill set.

With Cloudways on board, DigitalOcean can offer pre-built configurations that require no management.

Example: Pre-Built DigitalOcean VPNs

For example, you can currently build your own VPN with DigitalOcean, but you still need to install and configure the application on your own. With Cloudways integrated into the system, I can imagine pre-packaged VPN servers that require almost no management. DigitalOcean can offer an entire VPN as a hands-off service for a monthly fee.

Now that Cloudways has opened the door to value-add services on the DigitalOcean infrastructure, I foresee an explosion of custom services with DigitalOcean providing the back-end infrastructure.

I’m Very Excited about DigitalOcean’s Future

DigitalOcean isn’t a flashy company, and not many people have heard of it outside the world of web hosting and cloud technology. But since I’m in the web hosting industry, I know what a great product it is, and I’ve fired up several VPS servers on the DigitalOcean architecture. I can get started with a VPS within minutes and pay pennies to test a configuration. But setting up a web server with all the security and updates was always a challenge.

With Cloudways, the potential for the expansion of DigitalOcean services is limitless, not to mention extending its reach to an entirely new market. Cloudways and DigitalOcean are high-growth companies, and it’s great to see them combine synergies. The losers in this deal are DigitalOcean’s competitors like Linode and Vultr, who won’t have access to the same breath of services that DigitalOcean can provide.

While there won’t be any initial impact on DigitalOcean’s bottom line, I expect that to change soon. The company is already a hair’s breadth away from being GAAP profitable, with free cash flow for the past two quarters. So for DigitalOcean investors, this is nothing but good news.

Speak Your Mind